mississippi income tax rate 2020

Mississippi has a 700 percent state sales tax rate. Mississippi has a graduated tax rate.

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

For the Single Married Filing Jointly Married Filing Separately.

. Hurricane Katrina Information. There are -882 days left until Tax Day on April 16th 2020. Tax rate of 4 on taxable income between 5001 and 10000.

IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107. Find your pretax deductions including 401K flexible account. Sources of State and Local Tax Collections FY 2020 August.

Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The 2020 COVID-19 Mississippi Business Assistance Act. Mailing Address Information.

0 on the first 3000 of taxable income. Find your income exemptions 2. The graduated income tax rate is.

All other income tax returns P. 80-100 Individual Income Tax Instructions. Tax Rates Exemptions Deductions.

Tax rate of 5 on taxable income over 10000. 3 on the next 1000 of taxable income. 4 on the next 5000 of taxable income.

Mississippi has a graduated income tax rate and is computed as follows. How do I compute the income tax due. 0 on the first 4000 of taxable income.

Eligible Charitable Organizations Information. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his. Mississippis income tax brackets were last changed.

There is no tax schedule for Mississippi income taxes. The chart below breaks down the Mississippi tax brackets using this model. Mississippi has a graduated tax rate.

Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 100000 and 500000 youll pay. Taxable and Deductible Items. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Mississippi income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31 2020. How Income Taxes Are Calculated. 3 on the next 2000 of.

These rates are the same for individuals and businesses. Evaluating Mississippis Plan to Phase Out the Individual Income Tax. 71-661 Installment Agreement.

These rates are the same for individuals and businesses. The graduated income tax rate is. Combined Filers - Filing and Payment Procedures.

Senate Bill 2858 2016 Legislative Session - Miss. Unlike the Federal Income Tax Mississippis state income tax does not provide. Mississippi also has a 400 to 500 percent corporate income tax rate.

How to Calculate 2020 Mississippi State Income Tax by Using State Income Tax Table 1. There is no tax schedule for Mississippi income taxes. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

5 on all t See more. Mississippi Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 0 0 - 3000 0 within Bracket 3 3001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. Corporate and partnership income tax. 27-7-5 and 27-7-18 Beginning with tax year 2018 the 3 tax rate.

18 Progressive Tax States Have Top Marginal Tax Rates That Treat Wirepoints

Mississippi State Income Tax Ms Tax Calculator Community Tax

Commentary Mississippi Should Invest In Its People Not Chase The False Promise Of Tax Competitiveness Center On Budget And Policy Priorities

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Mississippi Income Tax Brackets 2020

Where S My Refund Mississippi H R Block

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Tax Rate H R Block

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Mississippi Could Soon Tax Third Party Internet Sales The Northside Sun

Mississippi Tax Forms And Instructions For 2021 Form 80 105

State Individual Income Tax Rates And Brackets Tax Foundation

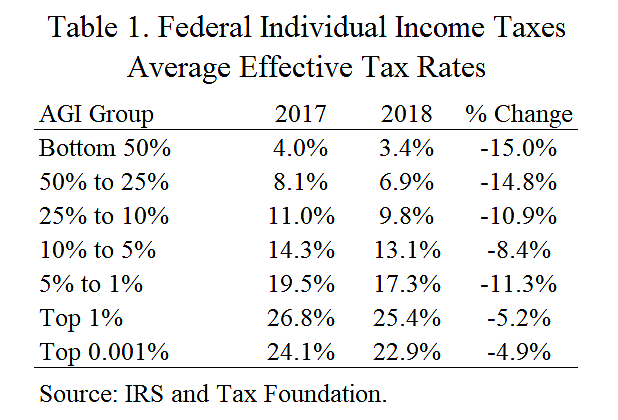

Tax Rates By Income Level Cato At Liberty Blog

Tax Withholding For Pensions And Social Security Sensible Money

Mississippi Income Tax Reform Details Evaluation Tax Foundation